The Tories have always boasted that privatisation of major industries has been good for the economy and good for Britain. A rain-check on the history of Thatcher’s mass programme of privatisation now suggests otherwise. Who thinks the privatisation of energy, or of water, or of telecoms (or of the Post Office) has been a roaring success either for the economy or for consumers, as opposed to an opportunity for exploitation and a rip-off for customers? Much less mentioned, but equally if not more significant, is what has happened to the privatised car industry. It still suffers from a massive trade deficit, with £48bn of vehicles and parts imported last year – that is nearly half of Britain’s net manufacturing trade deficit – with profits and control lost abroad probably for ever. A worse deal than that is difficult to imagine. Continue reading

The Tories have always boasted that privatisation of major industries has been good for the economy and good for Britain. A rain-check on the history of Thatcher’s mass programme of privatisation now suggests otherwise. Who thinks the privatisation of energy, or of water, or of telecoms (or of the Post Office) has been a roaring success either for the economy or for consumers, as opposed to an opportunity for exploitation and a rip-off for customers? Much less mentioned, but equally if not more significant, is what has happened to the privatised car industry. It still suffers from a massive trade deficit, with £48bn of vehicles and parts imported last year – that is nearly half of Britain’s net manufacturing trade deficit – with profits and control lost abroad probably for ever. A worse deal than that is difficult to imagine. Continue reading

Tagged with Water

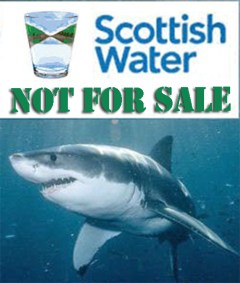

The sharks are circling Scottish Water

Scottish Water is a public corporation that delivers a publicly owned water and sewerage service to the people of Scotland, unlike the privatised service in the rest of the UK. It’s a model that has served Scotland well, delivering clean fresh Scottish water to homes and businesses and removing sewage along some 60,000 miles of pipes. Despite our challenging geography the average Scottish water bill is lower than the average bill in England and Wales.

Scottish Water is a public corporation that delivers a publicly owned water and sewerage service to the people of Scotland, unlike the privatised service in the rest of the UK. It’s a model that has served Scotland well, delivering clean fresh Scottish water to homes and businesses and removing sewage along some 60,000 miles of pipes. Despite our challenging geography the average Scottish water bill is lower than the average bill in England and Wales.

Scottish Water has delivered a massive capital programme to update our aging infrastructure. It spends just under £500m a year on infrastructure including pipes and treatment works, funded largely by the water charge payer with borrowing support from the Scottish Government. Continue reading

The public wants rail, water, energy re-nationalised, and it needs doing

The latest figures show that a season ticket, including tube travel, from Woking in Surrey to central London cost £3.268 last year. A similar 22-mile journey in Italy from Velletri to Rome cost just £336. In France the 24-mile journey from Ballancourt to Paris costs £924. The RMT argues that the vastly higher costs of rail travel in the UK largely reflect the fragmentation of the rail system into a myriad pieces. Removing complex interfaces, transaction costs, increased debt servicing and private profit, and dividend payments from the industry could save more than £1bn a year, leading to lower fares and less public subsidy. Altogether they believe that since privatisation more than £11bn of public funds hsve been mis-spent on debt write-offs, dividend payments to private investors, fragmentation costs , including profit margins of complex tiers of contractors and sub-contractors, plus higher interest payments to keep Network Rail’s debts off the government’s balance sheet. Not a way to run a railway.

The latest figures show that a season ticket, including tube travel, from Woking in Surrey to central London cost £3.268 last year. A similar 22-mile journey in Italy from Velletri to Rome cost just £336. In France the 24-mile journey from Ballancourt to Paris costs £924. The RMT argues that the vastly higher costs of rail travel in the UK largely reflect the fragmentation of the rail system into a myriad pieces. Removing complex interfaces, transaction costs, increased debt servicing and private profit, and dividend payments from the industry could save more than £1bn a year, leading to lower fares and less public subsidy. Altogether they believe that since privatisation more than £11bn of public funds hsve been mis-spent on debt write-offs, dividend payments to private investors, fragmentation costs , including profit margins of complex tiers of contractors and sub-contractors, plus higher interest payments to keep Network Rail’s debts off the government’s balance sheet. Not a way to run a railway.

The Tory rationale for privatisation – that it would be more efficient – has been shown unequivocally to be false. State subsidies since the system went private have more than doubled. On the East Coast mainline two previous private operators have collapsed. But the service then run directly by the State has been strikingly successful. Directly Owned Railways significantly improved pre-tax profits, increased passenger journeys, and raised customer satisfaction and punctuality performance. Continue reading

And another thing… time to take back water into public ownership

Did you know that two-thirds of our water companies are owned by foreigners? Does it matter? Well, yes it does. They can major on water supplies in their own home country and neglect the UK arm of their business, they can fail to deal quickly or adequately with leaks in the UK even when it involves foul water, and they can decline to invest in urgently needed new facilities.

Did you know that two-thirds of our water companies are owned by foreigners? Does it matter? Well, yes it does. They can major on water supplies in their own home country and neglect the UK arm of their business, they can fail to deal quickly or adequately with leaks in the UK even when it involves foul water, and they can decline to invest in urgently needed new facilities.

The classic example of the latter is Thames Water, owned by the Australian bank Macquarie, which is now demanding that the UK taxpayers shell out £4bn for a new so-called super-sewer, despite having drained off huge profits and imposed fast rising prices since privatisation. Continue reading